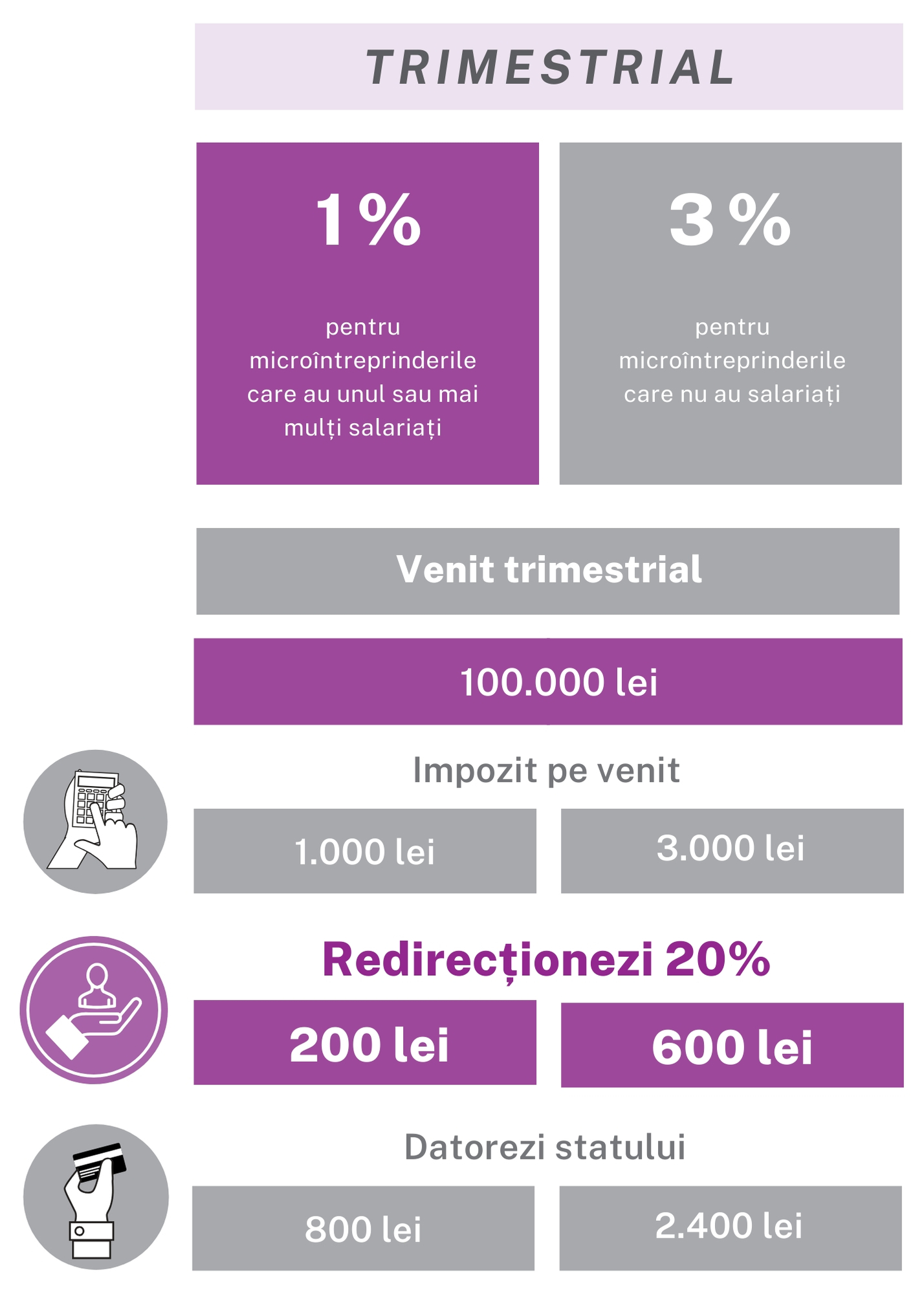

20% OF THE CORPORATE/INCOME TAX

WHAT IT IS

An annual tax facility whereby companies- can choose to direct 20% of their profit/income tax to a social cause at no cost (does not affect the company’s net profit/income).

HOW IT WORKS

Companies owe 16% corporation tax to the state annually. Under a simple sponsorship contract, companies can direct 20% of the corporate tax due to the state to the cause of vulnerable young people in Romania, provided that the amount of the sponsorship is less than 20% of the corporate tax due or 0,75‰ of the turnover (whichever is lower).

–

Sponsorship can be made in full (once a year for companies) – and is deducted from the income tax for the reference period.

The allocation of the corporate tax must be made by the date of filing the corporate income tax form and not after, as from December 2023.

CALCULATION MODEL

WHAT STEPS TO TAKE

- Download the draft sponsorship contract at the bottom of this page

- Fill in the downloaded contract with the company’s details (ours are already filled in) and the amount of the 20% of the profit/income tax, together with the accounting department

Send the completed and scanned contract to us at office@asociatiasocialincubator.org

If you have any further questions regarding the sponsorship process, please do not hesitate to contact us and we will answer all your questions.

+40790599908 / office@asociatiasocialincubator.org